Aggregation delivers more savings than subsidy in recent Indian electric bus tenders

Indian cities are now returning to pre-Covid travel demand levels and as a result, many bus agencies across the country are undertaking large-scale electric bus procurements. Cities are adopting varied models to reduce the cost of electrification. Upfront subsidies to reduce the cost of the bus, aggregation of demand, and large-scale procurement to bring in economies of scale and a combination of these measures are the key strategies cities are adopting. Apart from these, the electric bus procurement specifications covering the technical and financial aspects of the contract are being streamlined and improved with every new contract. In this article, we summarise the key trends emerging from four recently concluded tenders to understand the relative impact of subsidies and demand aggregation.

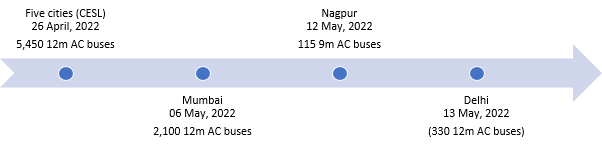

Framing timeline of E-Bus Tenders

Over the past one month, a total of about 8,000 (7,995 to be precise) electric bus tenders being closed and evaluated across India. This included the aggregated procurement of 5,450 electric by Convergent Energy Services Limited (CESL), believed to be the world’s largest single tender for electric buses, 2,100 buses tendered by the Brihanmumbai Electric Supply and Transport Undertaking (BEST) for Mumbai, 330 buses by Delhi Integrated Multi-Modal Transit System (DIMTS) and 115 buses by Nagpur Municipal Corporation (NMC). The timeline of financial evaluation of bids received by these tenders is shown below to indicate the likely impact of the results of one tender on the remaining ones.

The 5,450 buses tendered by CESL were for five cities: Delhi, Kolkata, Bengaluru, Hyderabad and Surat spread across five lots which had varying combinations of 12 meter and 9 meter buses, Air-Conditioned (AC) and Non-AC buses, low-floor height (400 mm) and standard floor height (900 mm) buses. All of these tenders followed the Gross Cost Contract (GCC) model of procurement where the bidder quotes a per-km cost for the contracted-km after factoring the available subsidy. The bidder providing the Least Cost (L1) quote will be selected for deployment, while in some cases second and third least cost quotes (L2/L3) are selected subject to matching L1 subsidy.

Analysing outcomes of four tenders

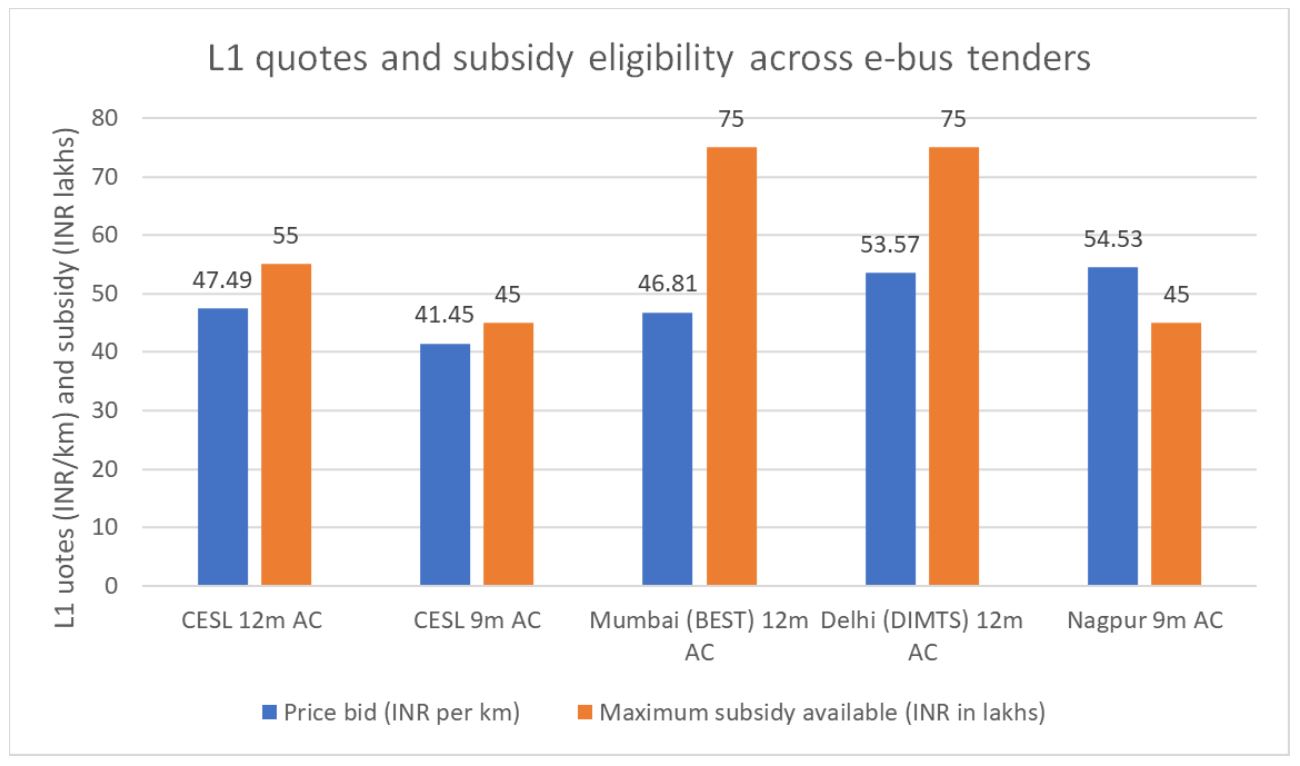

The quotes received by these tenders show some interesting findings. The price bid result of the CESL procurement for 12m AC buses is INR 47.49 per-km and 9m AC buses is INR 41.45 per-km assuming labour costs of Delhi. These would later be customised for other cities based on their minimum-daily wage labour rates assuming 30% of quoted cost to be on labour. Tata Motors was the winning bidder across all five lots. BEST-Mumbai received quotes lower than CESL at INR 46.81 per-km for the 1400 12m AC buses. The order was later scaled up to 2,100 buses to benefit from the competitive rates. Nagpur (NMC) received a lowest quote of INR 54.53 per-km for the 115 9m AC buses from PMI-Foton. Finally, the mostly recently concluded DIMTS received quotes in two clusters E1 and E2 with 190 and 140 12m AC buses respectively. The lowest price quoted was INR 55.95 per-km by Tata motors for cluster E1 and INR 53.57 per-km by PMI-Foton for cluster E2. The summary is shown below:

Mumbai’s quote was approximately 1.5% lower than the quote received by CESL for a 12m bus with similar technical and operational specifications. While Mumbai tendered out fewer buses compared to CESL, it also has a subsidy eligibility of INR 75 lakh per bus subsidy available in comparison to CESL INR 55 lakh for an equivalent bus. The actual subsidy amount will be the lower of eligible subsidy and 40% of the cost of the bus, to be estimated based on a formula linked to the per-km cost quoted. Hence, in both the cases, the actual subsidy amount would be lesser than the maximum eligible subsidy amount. DIMTS offered a fixed subsidy of INR 75 lakh per bus but the rates received were approximately 13% higher than CESL quotes for a similar bus. This could be attributed to the low volumes on offer per tender. In case of Nagpur, despite tendering for 9m buses, the quotes received were higher than the 12m quotes in other cities. Nagpur also had the lowest number of buses on offer among the four tenders analysed.

The tenders analysed are also part of the larger scope of the Memorandum of Undertaking (MoU) signed between CESL and UITP India on 10 February 2022. The goal of the MoU is to work together on advancing electric buses by identifying electric bus procurement principles, improve city-level preparedness for transitioning to electric buses and share peer learnings between cities to adopt robust and adaptative business models. The MoU with CESL was under the larger umbrella of the projects that UITP has undertaken in India on electric buses i.e., ‘Soot-Free Low-Carbon Public Fleet – Case study of Bangalore Metropolitan Transport Corporation (BMTC)’ supported by International Council on Clean Transportation (ICCT) since 2018 and ‘Enabling Mechanisms to Advance Electric Buses in India’ funded by a US based Philanthropic organisation since 2021. The support to MoU was also based on the extensive study done on FAME II tenders in a project funded by Shakti Sustainable Energy Foundation.

Aggregation of buses acting as a major factor in price quotation

In summary, the comparison of the CESL quotes with BEST and DIMTS quotes clearly show that the quoted costs are influenced more by the volume of buses on offer rather than the subsidy. This can be attributed to the life-cycle returns of the project because more bus-km on offer in larger scale tender provide better returns than the one-time capital incentives that the service provider is eligible for. Even in the quotes received by DIMTS and Nagpur, the quoted costs are in the range of INR 53-55 per km which is a clear drop in prices compared to the INR 60-80 per-km received in the previous round of tenders by cities. Not only have the overall prices reduced, they are also closer to each other-probably due to the standardisation in procurement specifications that the Indian market is moving towards.

In summary, the recent electric bus procurement efforts point towards the following key trends:

- Indian cities are now moving from pilots to large scale transition to electric buses

- There’s a significant reduction in the overall costs quoted and more uniformity emerging in the prices being quoted across cities

- Aggregation of demand and large scale procurement is yielding higher savings compared to cost reduction due to subsidies

However, it has to be noted that the prices discovered in large scale tenders can be influenced by the bidders urge to take up the large scale project on offer rather than being a true reflection of the actual cost of services to be delivered. Cities need to ensure put in place the necessary performance monitoring mechanisms to ensure longevity of these projects.